sales tax in orange county california

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The sales tax also includes a 50 emissions testing fee.

Will You Pay More For Weed Than Your Friends It May Depend On Your City S Taxes Los Angeles Times

Currency only paid in person at the Office of the Treasurer-Tax Collector in the County Service Center located at 601 N.

. The one with the highest sales tax rate is 90720 and the one with the lowest sales tax rate is 90620. The minimum combined 2022 sales tax rate for Orange County California is 775. Orange County Sales Tax Rates for 2022.

1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. The average sales tax rate in California is 8551.

In California the seller traditionally pays the transfer tax. The bottom panel of the figure displays sales tax rates in the Los Angeles region. The 2018 United States Supreme Court decision in South Dakota v.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Orange County also assesses a sales tax for some items including a standard rate of a quarter of a percent and a special tax rate of 15. How do I pay for a Property at the Tax Sale.

Some areas may have more than one district tax in effect. The state of California keeps 600 of the sales tax collected and the additional 125 goes to the county 1 and city 25 funds. 175 lower than the maximum sales tax in CA.

How to Compare Sales. The party transferring or conveying title to the property is generally responsible for the payment of the tax. Box 1438 Santa Ana CA 92702-1438.

When a certificate is sold against a piece. The Orange County Florida sales tax is 650 consisting of 600 Florida state sales tax and 050 Orange County local sales taxesThe local sales tax consists of a 050 county sales tax. Internet Property Tax Auction.

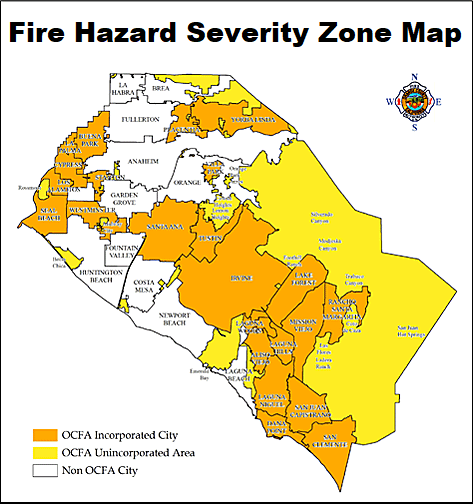

For map questions only please contact the Assessor at 714 834-2727. Of the 725 125 goes to the county government. On or before June 1 the Tax Collector must conduct a Tax Certificate Sale of the unpaid taxes on each parcel of property.

Method to calculate Orange County sales tax in 2021. The State of California currently charges a sales tax rate of 6. The Orange County Sales Tax is collected by the merchant on all qualifying sales made within Orange County.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The minimum combined 2022 sales tax rate for Orange County Florida is 65. The current total local sales tax rate in Orange County CA is 7750.

2020 rates included for use while preparing your income tax deduction. Several cities in this area have 10 percent rates while nearby Stanislaus County has a 76 percent rateone-eighth of a cent above the minimum. As far as all cities towns and locations go the place with the highest sales tax rate is Los Alamitos and the place with the lowest sales tax rate is Aliso Viejo.

Orange County collects an additional 050 which brings the Orange County sales tax 50 higher than the state minimum sales tax of 725. The sales tax rate for Orange County was updated for the 2020 tax year this is the current sales tax rate we are using in the Orange County California Sales Tax Comparison Calculator for 202223. Here is the breakdown of the of 725 minimum CA sales tax.

The most populous zip code in Orange County California is 92683. The Florida state sales tax rate is currently 6. The combined sales tax rate imposed by the State and the County presently stands at 775.

Groceries are exempt from the Orange County and Florida state sales taxes. For in person tax sales payment must be made in cash US currency only limited to 10000 or a state or federally chartered bank-issued cashiers check made payable to the County of Orange. 82 rows The total sales tax rate in any given location can be broken down into state county city and special district rates.

How Much Is the Car Sales Tax in California. The 2018 United States Supreme Court decision in. The sale is operated on a competitive bid basis with interest bids beginning at 18 and progressing downward.

How to Calculate California Sales Tax on a Car. This is the total of state and county sales tax rates. California has a 6 sales tax and Orange County collects an additional 025 so the minimum sales tax rate in Orange County is 625 not including any city or special district taxes.

The Orange County Sales Tax is collected by the merchant on all qualifying sales made. Orange County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Orange County totaling 025. Ad Find Out Sales Tax Rates For Free.

The Orange County sales tax rate is 05. The top panel of the figure below illustrates this variation in part of the Bay Area and some surrounding counties. The advertising and collection cost is added to the delinquent bill.

The 775 sales tax rate in Orange consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. Those district tax rates range from 010 to 100. You can print a 775 sales tax table here.

Some California municipalities also possess the. For tax rates in other cities see California sales taxes by city and county. Fast Easy Tax Solutions.

The California state sales tax rate is currently 6. The Orange County California sales tax is 775 consisting of 600 California state sales tax and 175 Orange County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. The Orange County sales tax rate is 025.

There are some jurisdictions that dictate who pays the tax but mostly there is no mandate and its up to the buyer and seller to negotiate who makes the payment. Sales tax in California varies by location but the statewide vehicle tax is 725. Orange CA is in Orange County.

The latest sales tax rate for Orange CA. This is the total of state and county sales tax rates. If this rate has been updated locally please contact us and we will update the sales tax rate for Orange County California.

The statewide tax rate is 725. This rate includes any state county city and local sales taxes. The December 2020 total local sales tax rate was also 7750.

You can find more tax rates and allowances for Orange County and California in the 2022 California Tax Tables. The local government cities and districts collect up to 25. Orange is in the following zip codes.

There is no applicable city tax. County of Orange. This table shows the total sales tax rates for all cities and towns in Orange.

What is the sales tax rate in Orange County. Sellers are required to report and pay the applicable district taxes for their taxable.

Understanding California S Property Taxes

All About California Sales Tax Smartasset

Understanding California S Property Taxes

Who Pays The Transfer Tax In Orange County California

Orange County Property Tax Oc Tax Collector Tax Specialists

Orange County Home Prices Hit Record 950 000 Up 201 500 In Pandemic Era Orange County Register

Understanding California S Sales Tax

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Food And Sales Tax 2020 In California Heather

Who Pays The Transfer Tax In Orange County California

Understanding California S Property Taxes

California Sales Tax Rates By City County 2022

Sales Tax In Orange County Enjoy Oc

Food And Sales Tax 2020 In California Heather

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes